One of the ways that many traders make decisions while trading options is by using Cryptocurrency indicators. Cryptocurrency indicators are markers that locate the patterns that exist in the currency market. This information can then be used to make decisions, including when to buy and sell options. This article will teach you all about Cryptocurrency indicators, including why they are valuable, how they work, and how to make them work for you.

| TRADING ROBOT | RATING | PROPERTIES | TRADE |

|

|

✔ 86% Declared Win-rate ✔ $250 Deposit ✔ Accepts Credit Card |

Trade NowRead Review |

FAQs About Cryptocurrency Indicators

Why are Cryptocurrency indicators valuable?

Cryptocurrency indicators are valuable because they offer insight into specific price data that will show upward or downward trends in the market. A trader builds their own group of indicators that they rely on for quick decision making.

How do Cryptocurrency indicators work?

Cryptocurrency indicators are determined by a computer (electronically) or a person (manually). They look at data from a specific time period and then come up with a value that best describes it. Trends in these values are tracked and when a specific trend is spotted, it sends out a signal in the form of a Cryptocurrency indicator.

How to Use Cryptocurrency Indicators

Cryptocurrency indicators should be viewed as signals to a trader. They signal a specific trend, perhaps one that the trader has profited from before or one that may cause them to lose money if they retain ownership of it. Then, the trader can decide whether to buy or sell certain options based on the signals they receive from the indicators.

Here are some of the most popular Cryptocurrency indicators:

- Bollinger Bands

- Simple Moving Average

- Rate of Change

- Moving Average Convergence/Divergence

- Exponential Moving Average

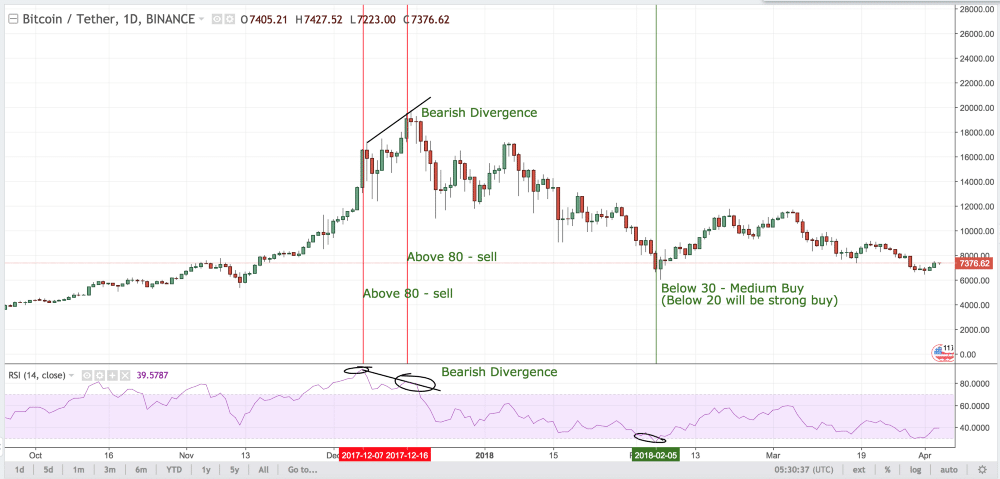

- Relative Strength Index

- Average Directional Index

- Parabolic Stop-and-Reversal

- Momentum

Often, traders will use their own combination of a few (or several) of these to make decisions in the options market.

Tips for Maximizing Your Profit

#1: Use Entry AND Exit Signals

One of the biggest mistake that new traders make is having a signal of an upward trend in the currency market and knowing to enter, but not using indicators of downward trends that may signal the time to exit. To minimize loss of profit, you should have both entry and exit Cryptocurrency indicators.

#2: Pay Attention to Reversals

It is not uncommon for upward trends to start slowly spiraling back down. Make sure that your Cryptocurrency indicators are watching for the downslide that is sure to follow an upward trend so you know when to sell for maximum profit.

#3: Stack Indicators for Increased Accuracy

Do not rely on any one indicator. Instead, use several indicators after the first has signaled an upward or downward trend. In this sense, you will be able to ensure you are making the best financial decision and act within the most profitable amount of time.

Options trading can be a profitable hobby (or career), especially once you know what you are doing. Learning the right Cryptocurrency indicators to use and tracking trends of the market can help you strategize for your trades.

| TRADING ROBOT | RATING | PROPERTIES | TRADE |

|

|

✔ 86% Declared Win-rate ✔ $250 Deposit ✔ Accepts Credit Card |

Trade NowRead Review |